What is more important, the acquisition of new clients, or the retention of existing ones? It's a classic sales and marketing question and one that most CEOs would quickly answer with "both, of course." But it's not as simple as that. Resources are finite and when measuring your output you should be able to quantify what percentage of time and effort was put towards new clients vs. those you already have. Is 50-50 really the right number?

Why Customer Acquisition is Important

We're stating the obvious here, but increasing your customer base is the fastest way to grow your business and the most obvious way to reach short-term revenue goals. Don't assume it's the only way, however, as up-selling to an existing customer can sometimes prove more lucrative than what you'll make on a new client. And that's before we get to "lifetime value."

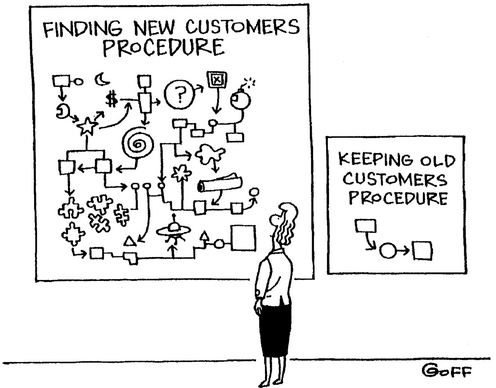

Source: Ted Goff

Source: Ted Goff

Customer acquisition will always be a driver for businesses, which is the main reason inbound marketing is such a rapid growth industry right now. Inbound tools are ideal for attracting qualified potential clients and converting them into sales.

SEE ALSO: How To Achieve Sales Growth With Inbound Marketing

Why Customer Retention is Important

Stepping aside from concerns of pure profitability, customer retention is one of the best ways to measure how reliably your company is providing its service. Put simply, companies with high retention rates are knocking it out of the park, and doing such good work their customers realize they would be worse off without them.

Strong customer retention rates can also be a great driver of customer acquisition, through referrals and the case study evidence you can provide to potential clients.

When it comes to revenue, customer retention is hugely important to consistent growth and financial planning. The more committed customers you have for the next financial quarter, the easier it is to make budgetry decisions. Another benefit of retained customers over acquired customers, is the fact they generally require less maintenance.

Breaking Down Customer Lifetime Value

When we talk about "customer lifetime value," what we're referring to is a prediction of the total profit generated by a customer over a projected period of time. Calculating this number helps businesses see the long-term vision, in terms of how valuable a client would be if retained for a set cycle.

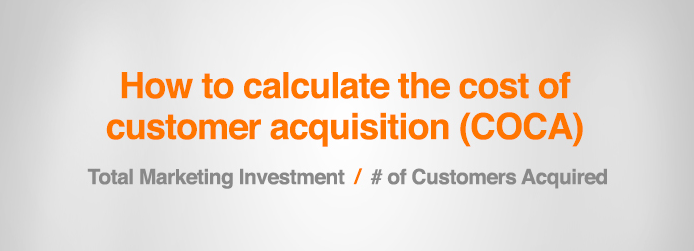

Source: Vital

Having a clear sense of customer lifetime value might help you make a decision on where to prioritize your resources - be it on retaining customers, or acquiring new ones. It also educates your long-term strategy, in terms of scaling your business and where your focus should be.

SEE ALSO: Is Inbound Marketing Right For My Business?

Crunching the Numbers

Here are some great numbers that were put together by ServiceInstitute, who conducted a survey:

- Acquiring a new customer is five times as expensive as retaining an existing customer.

- 44% of companies admit they, "have a greater focus" on acquisition, while 18% focus on retention (the rest claim to have an equal focus).

- 89% of businesses, "see customer experience as a key factor in driving customer loyalty and retention."

- 76% of companies see Customer Lifetime Value as "an important concept for their organization."

- The success rate of selling to a customer you already have is 60-70%, while the success rate of selling to a new customer is 5-20%.

- "Increasing customer retention rates by 5% increases profits by 25-95%."

Never Ending Debate

The customer aquisition vs. retention debate will run forever. How your company balances its resources should be educated by all the information you have available. To most, this is a difficult task. It's a lot to think about, but once you look at the numbers it's often more clear. If you would like to deepen your understanding of this topic, we are happy to help.

BACK TO ARTICLES

BACK TO ARTICLES